One platform to expand your business with trusted partnerships.

Connect online and offline with end-to-end payment and cash flow capabilities, powered by an API-first partner ecosystem.

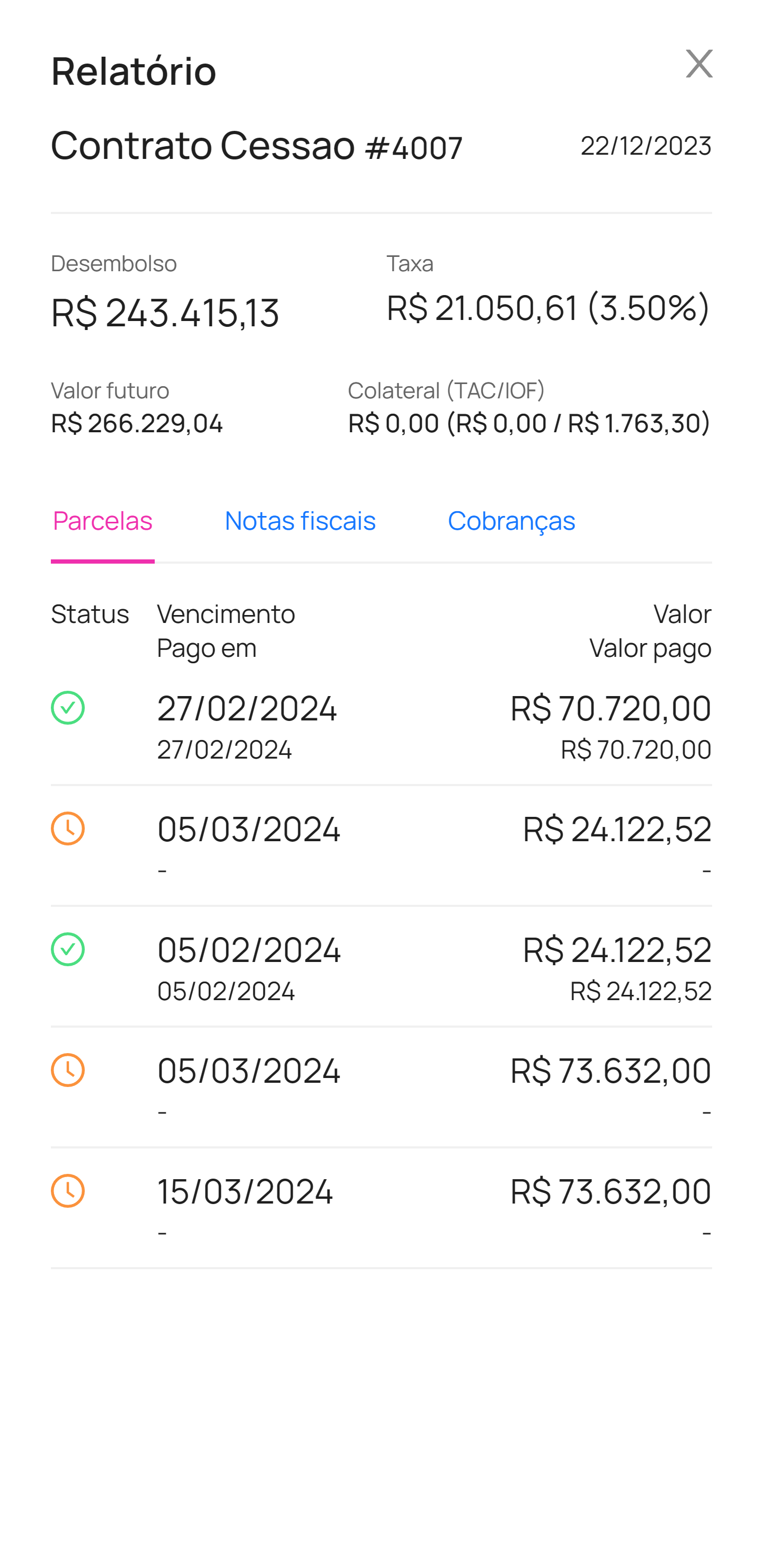

Data-Driven Financial Intelligence

Our advanced analytics engine analyzes customer transaction patterns and business relationships to optimize capital allocation and risk assessment for your entire ecosystem.

- Dynamic Capital Allocation

- AI-powered algorithms continuously optimize working capital limits based on real-time transaction data and customer behavior patterns across your platform.

- Progressive Risk Scoring

- Sophisticated machine learning models that improve capital access as customer relationships mature, enabling better financial outcomes for your users.

- Relationship Intelligence Platform

- Comprehensive payment history analysis that goes beyond traditional credit scoring to unlock capital based on actual business performance and payment behavior.

Supply Chain Finance Orchestration

Transform your business network into a strategic advantage with intelligent payment timing, supplier relationship optimization, and automated cash flow management.

- Instant Liquidity Infrastructure

- Provide immediate working capital to your suppliers and partners, enabling them to fulfill orders and maintain operations regardless of customer payment timing.

- Operational Continuity Platform

- Eliminate payment-related operational disruptions through predictive cash flow management and automated supplier payment optimization that maintains business momentum.

- Dynamic Payment Terms Management

- Intelligent payment flexibility that adapts to customer relationships and business cycles, maintaining strong partnerships while optimizing cash flow across your ecosystem.

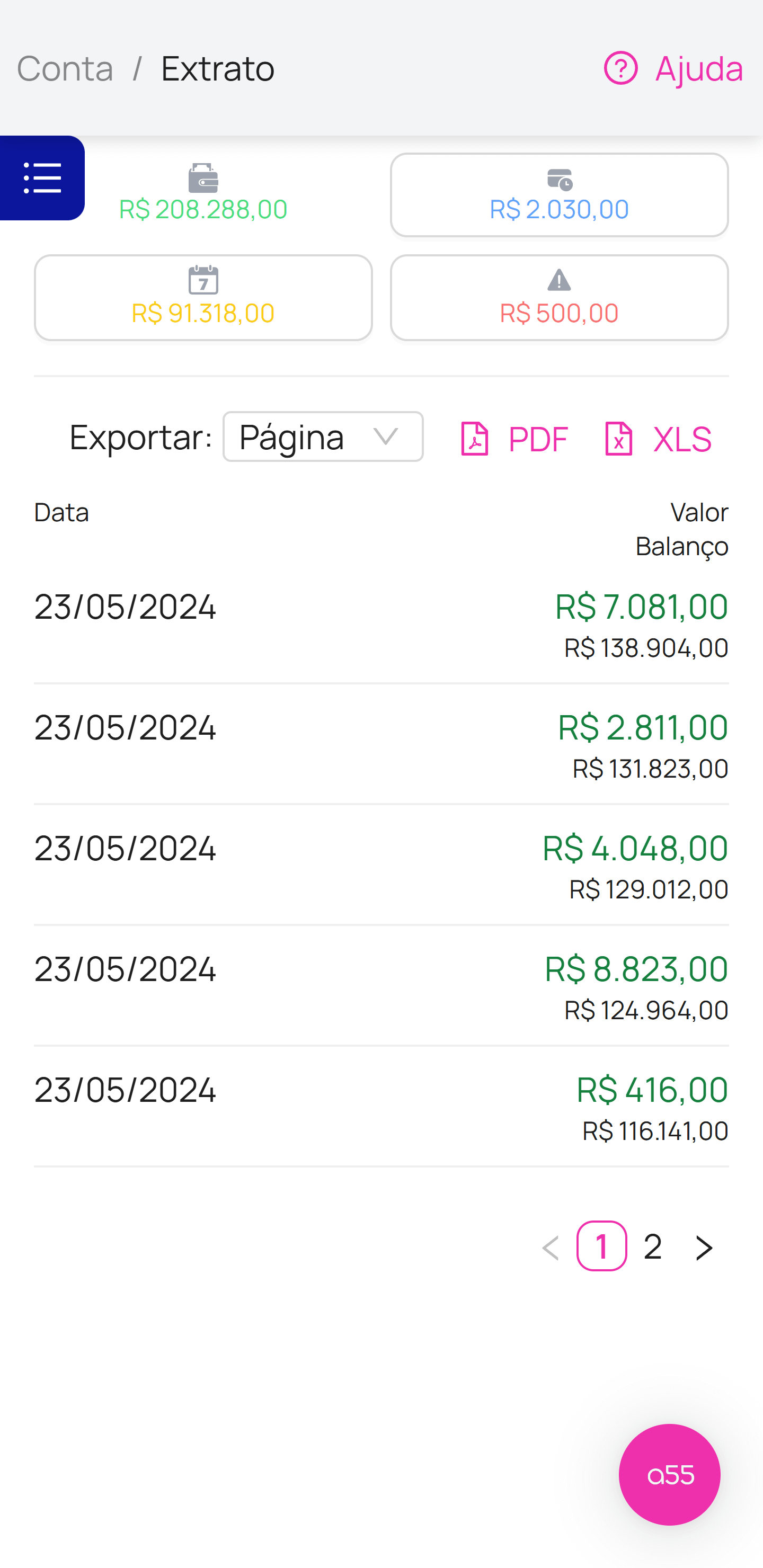

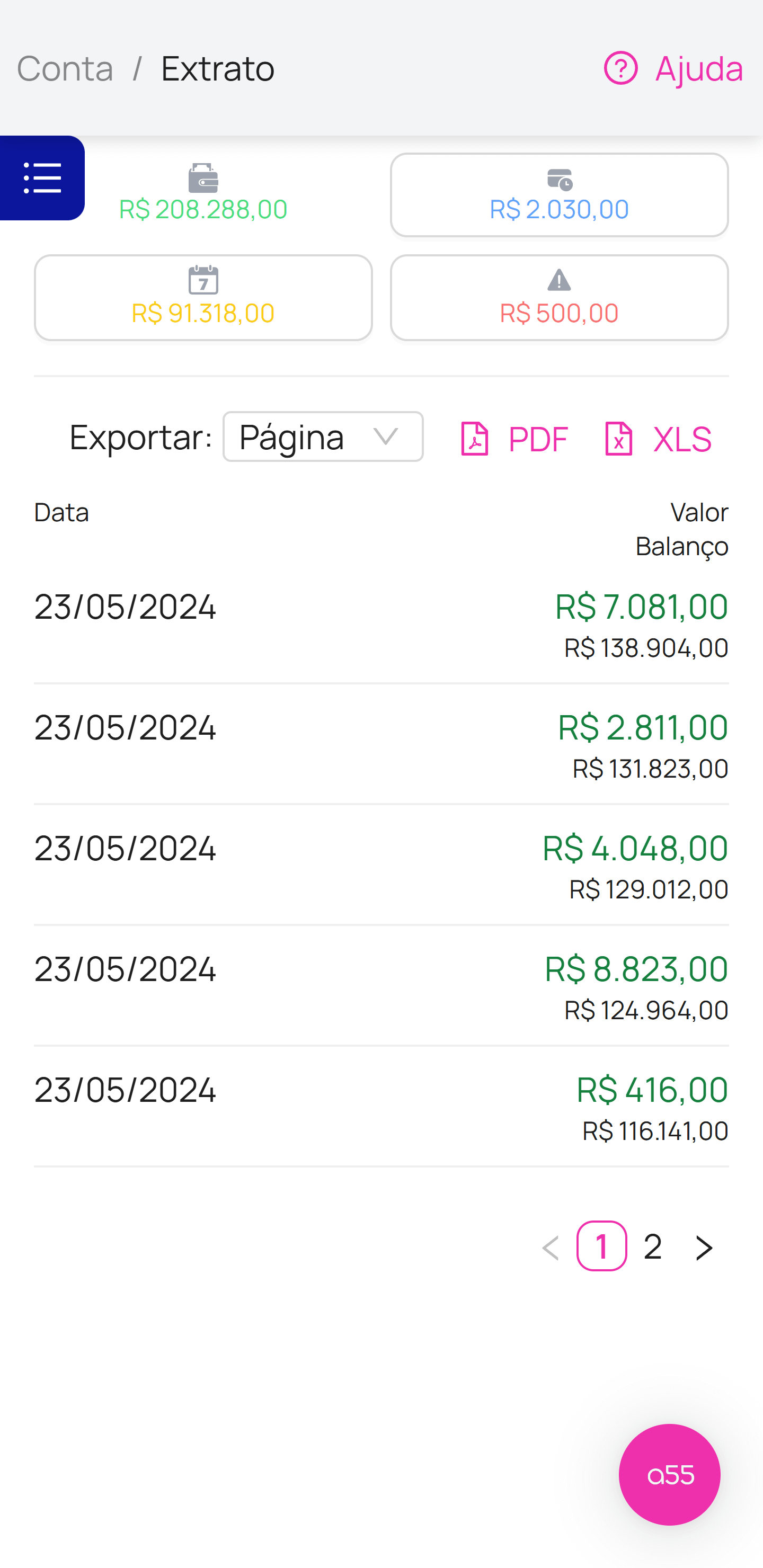

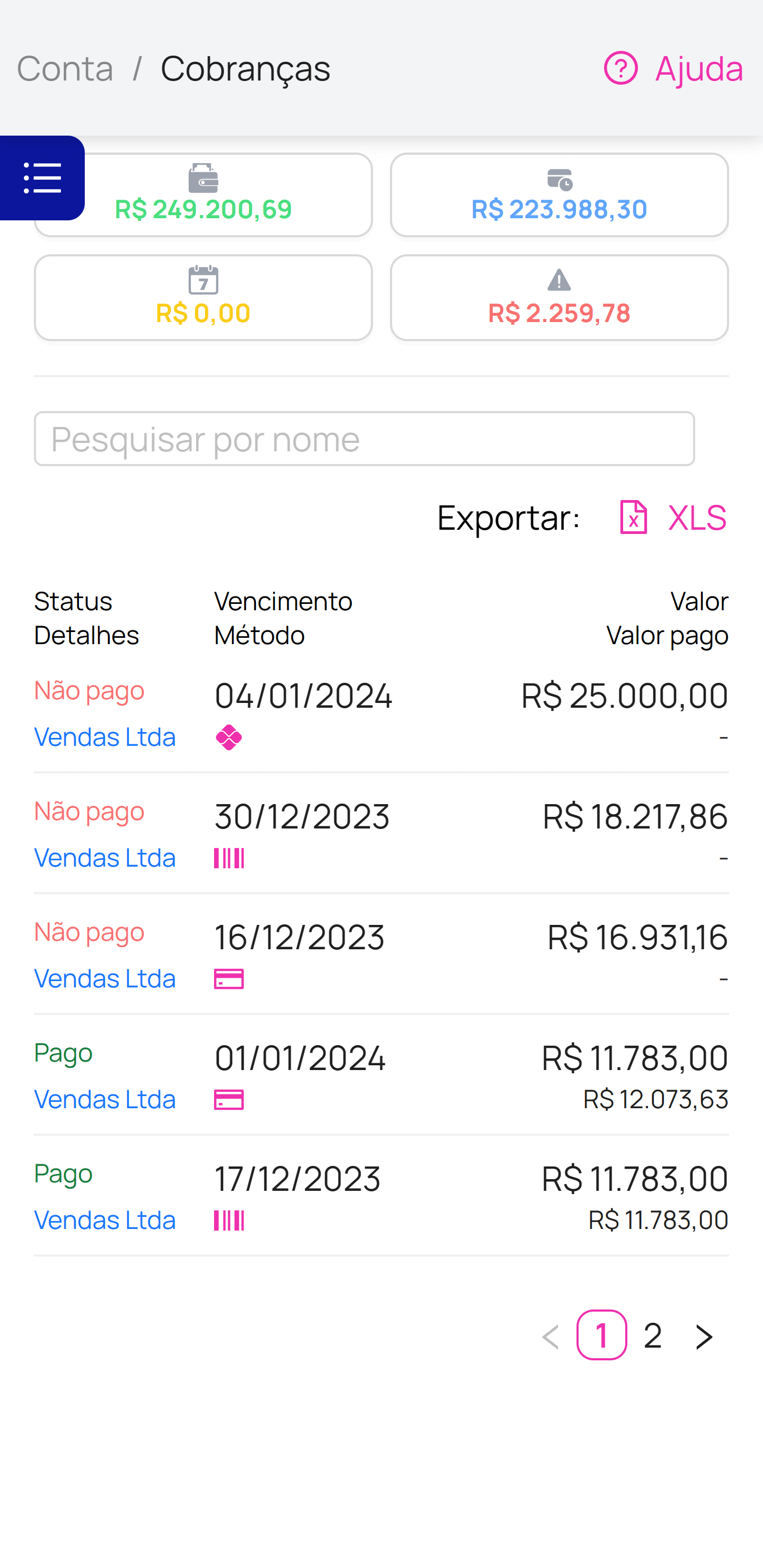

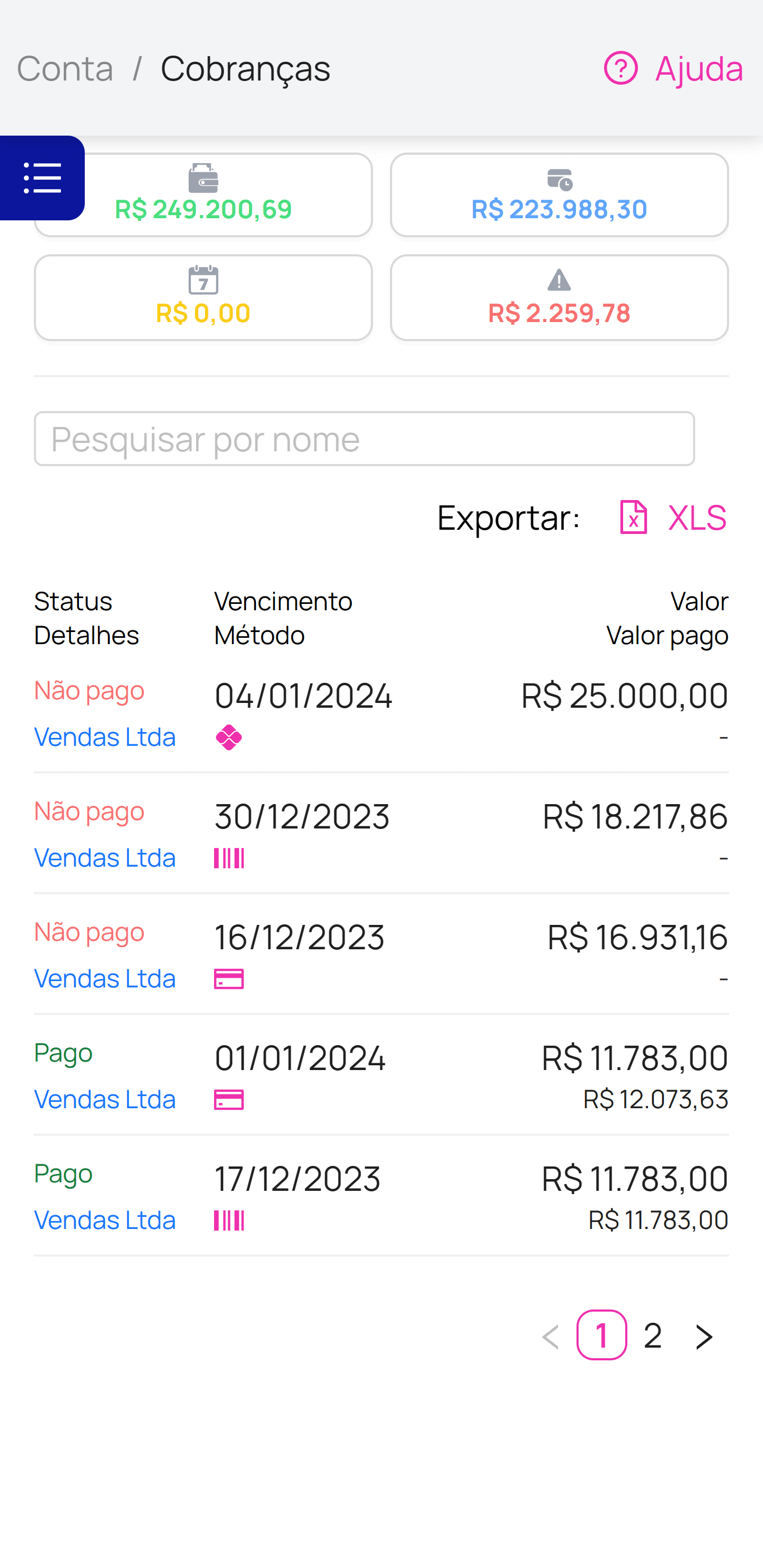

Real-Time Financial Intelligence Dashboard

Advanced analytics platform that provides comprehensive visibility into capital availability, transaction flows, and financial performance metrics across your entire business ecosystem.

- Ecosystem Capital Optimization

- Intelligent algorithms aggregate transaction data from all customer relationships to dynamically calculate and optimize available working capital across your platform in real-time.

One platform. Multiple partnership paths.

Our partner ecosystem combines technology, financial services, and regional expertise to extend your capabilities with API-first integrations and reliable operations.

- Technology Partners

- ISVs, SaaS, ERPs, and commerce platforms embed payments, reconciliation, risk, and working capital via modern APIs.

- Financial Services Partners

- Banks, issuers, and liquidity providers collaborate on settlement, issuing, capital, and treasury optimization.

- Regional & Payment Method Partners

- Local payment methods and acquirers expand coverage with compliant, high-performance acceptance.

API-first integration, built for scale

Developer-friendly integration with robust webhooks, observability, and SLAs. Designed for multi-tenant architectures and white-label implementations.

- Modern APIs & Webhooks

- RESTful endpoints, idempotency, and event-driven webhooks for reliable payment, settlement, and reconciliation workflows.

- Multi-tenant & Whitelabel

- Architecture supporting multi-tenant platforms with brandable experiences and delegated administration.

- Observability & SLAs

- Metrics, tracing, and uptime commitments that keep mission-critical payment operations predictable.

- Sandbox & Certification

- Dedicated sandbox, reference implementations, and certification flows to accelerate go-live.

Partner program for long-term growth

Build sustainable revenue with enablement, technical support, and joint go-to-market—aligned to measurable business outcomes.

- Co-selling & Enablement

- Sales playbooks, enablement assets, and solution engineering support across the partner lifecycle.

- Aligned Commercial Models

- Flexible commercial structures designed to scale with usage and value delivered.

- Technical Support & Escalations

- Priority technical assistance, architecture reviews, and roadmap collaboration.

- Compliance & Risk Collaboration

- Guidance on PCI, data protection, and risk operations to accelerate enterprise deployments.

Partner success

Examples of outcomes we achieve with partners in platform, financial, and regional alliances.

- Faster time-to-activation

- Streamlined onboarding flows, reference implementations, and certification reduce integration effort and accelerate go-live.

- Conversion & cost optimization

- Orchestrated routing and localized acceptance help improve approval rates while keeping processing economics efficient.

- Operational reliability

- Enterprise-grade monitoring, webhooks, and observability increase predictability for mission-critical payment operations.

Ready to Transform Your Business Ecosystem?

Partner with us to embed enterprise-grade financial infrastructure that creates new revenue streams and optimizes operations across your platform.

Frequently asked questions

Answer your questions about our products and services.

To receive a receivables advance line at a55, it is necessary to follow some requirements. Check them out below: Have an active CNPJ for at least 6 months; It cannot be MEI; You need to have legal accounts with the company's CNPJ; Have credit card sales not in advance; You cannot automatically advance receivables.