Unified payment infrastructure for growth

End‑to‑end payments, data, and cash‑flow operations in one API‑first platform.

Revenue Optimization Platform

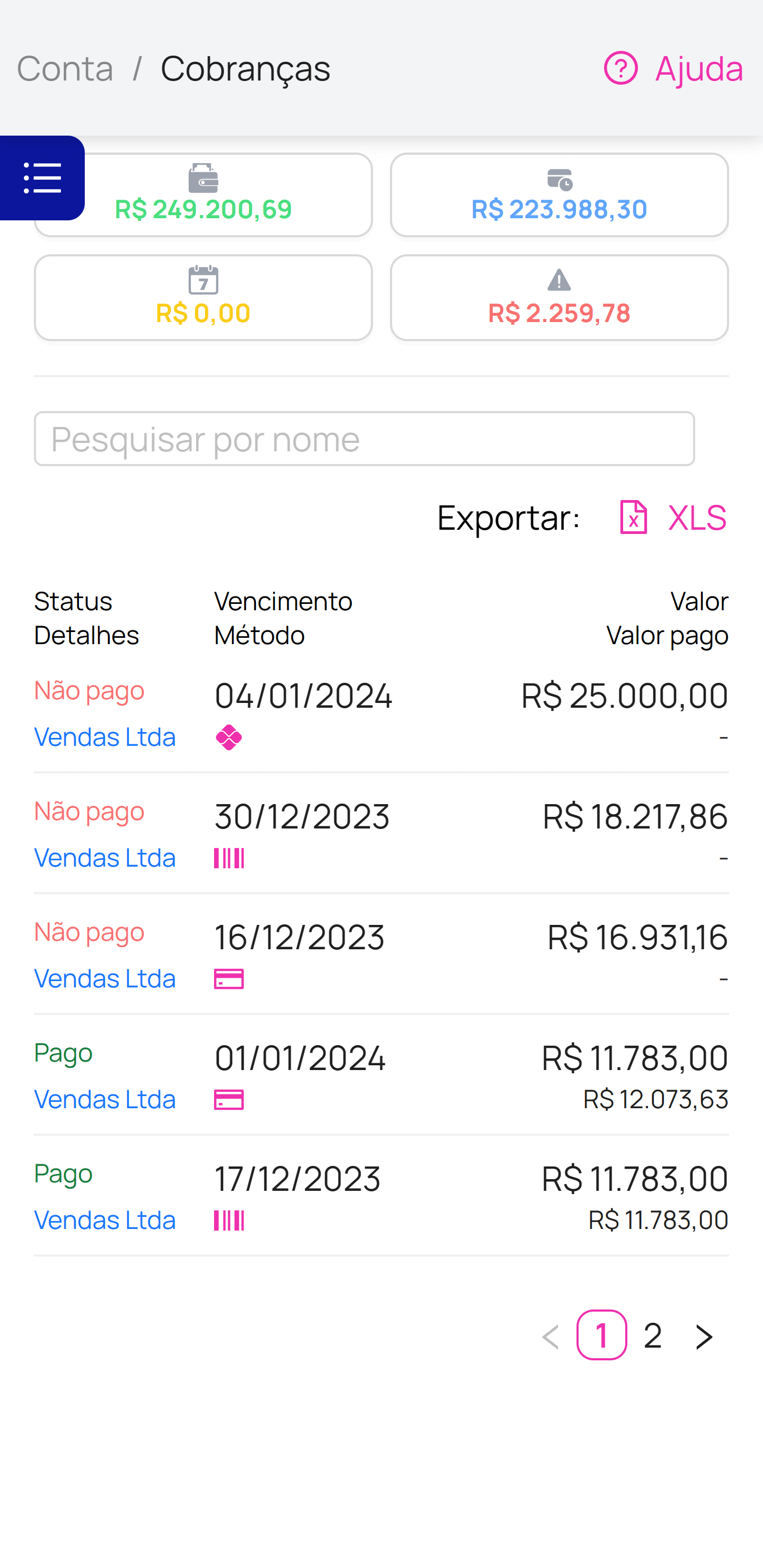

Receivables management with intelligent payment orchestration and automated workflows.

- Intelligent Collection Orchestration

- ML‑driven reminders and channel routing improve collections with customer‑friendly flows.

- Automated Reconciliation Infrastructure

- Match payments across channels and accounts; reduce manual effort with reliable automation.

- Real-time Receivables Intelligence

- Unified dashboard with real‑time status, risk signals, and predictive cash‑flow insights.

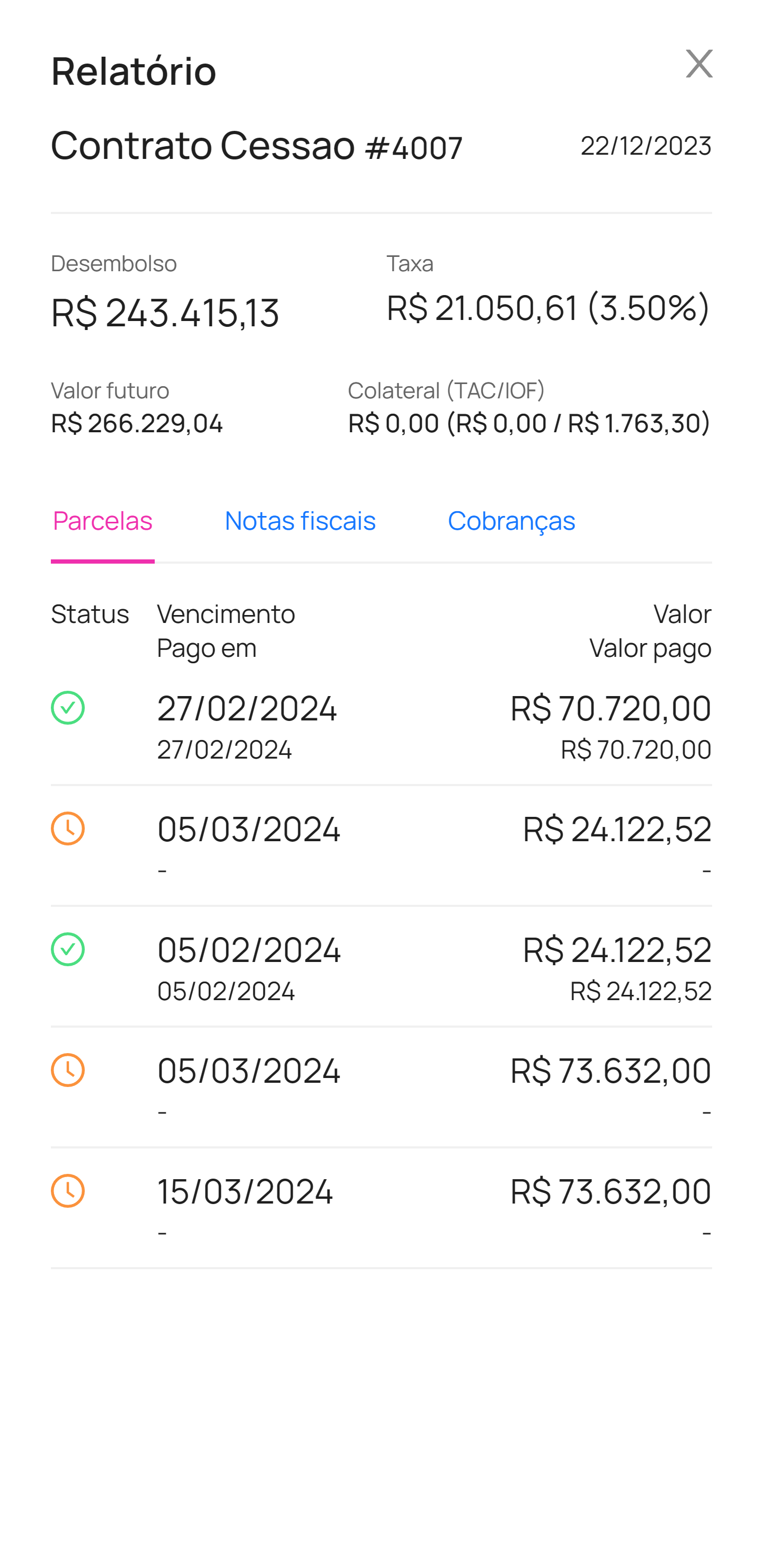

Payment Acceleration Infrastructure

Payment processing with cash‑flow optimization and enterprise‑grade settlement controls.

- Flexible Settlement Architecture

- Offer up to 12 installments with optimized processing and predictable settlement.

- Conversion Recovery Engine

- Reduce cart abandonment with automated reminders and smart retry logic.

- Multi-Acquirer Orchestration

- Route transactions across providers to improve approvals and economics.

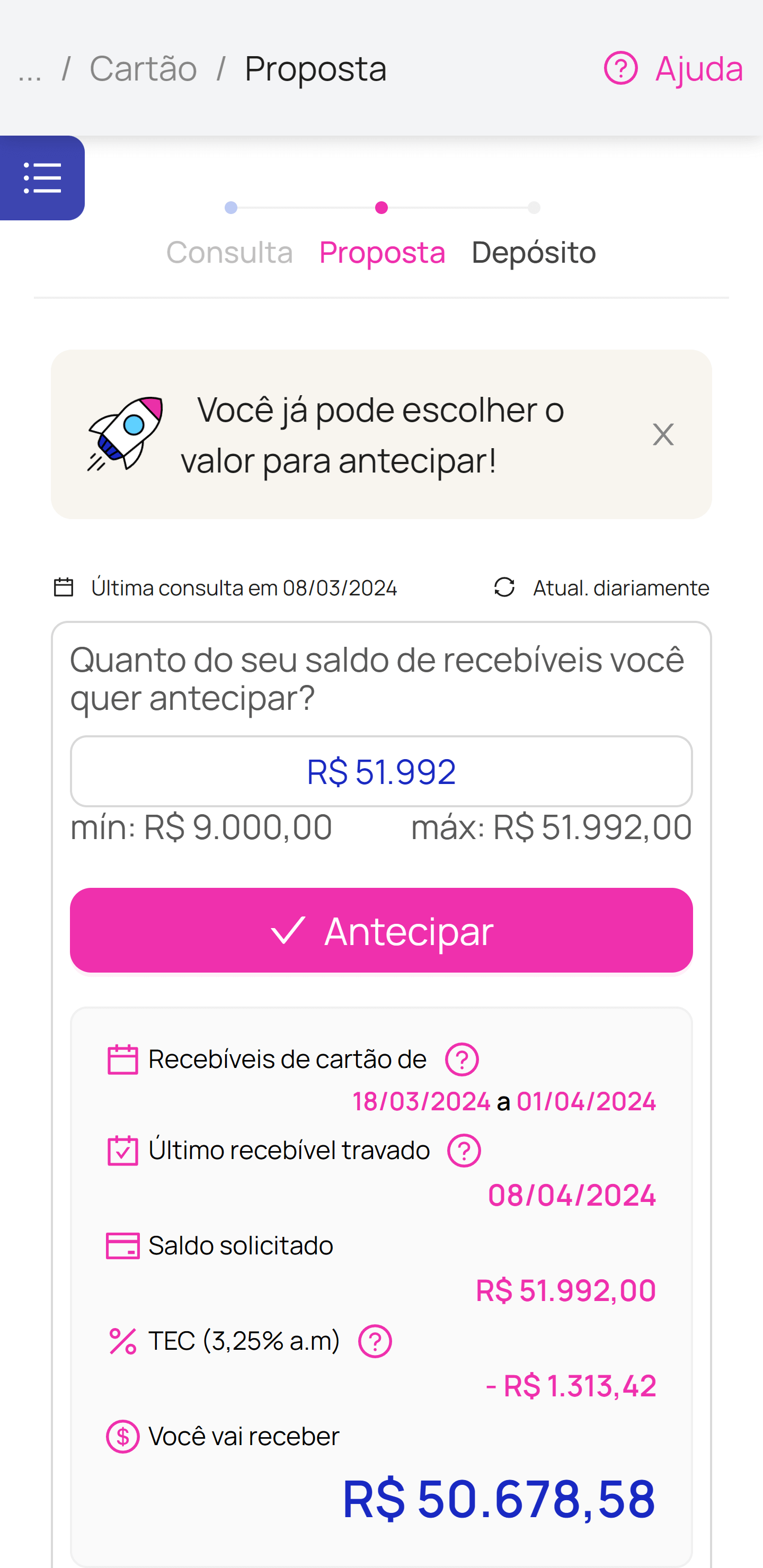

Cash Flow Infrastructure Platform

Working capital management with predictive analytics and automated cash‑flow optimization.

- Intelligent Working Capital Management

- Analyze payment patterns to inform capital allocation and automate cash‑flow actions.

- Supply Chain Finance Optimization

- Optimize payment timing to enable early supplier payments and strengthen relationships.

- Cost-Optimized Capital Infrastructure

- Leverage cost‑efficient capital structures aligned to risk and business usage.

Ready to Transform Your Payment Infrastructure?

Connect with our payment ecosystem experts to design a customized solution that accelerates your business growth.

Frequently Asked Questions

Answer your questions about our products and services.

To receive a receivables advance line at a55, it is necessary to follow some requirements. Check them out below: Have an active CNPJ for at least 6 months; It cannot be MEI; You need to have legal accounts with the company's CNPJ; Have credit card sales not in advance; You cannot automatically advance receivables.